- DataMigration.AI

- Posts

- The Biggest Hurdle in Core Banking Conversions? Taming Legacy Data

The Biggest Hurdle in Core Banking Conversions? Taming Legacy Data

Conquering the Legacy Data Hurdle.

What’s in it?

Many banks are dissatisfied with their core providers and are considering a switch.

Data migration is the most complex and costly barrier to core system modernization.

Not all data has equal value; a strategic, tiered approach to migration saves money.

You have three main choices for handling legacy data: full conversion, a hybrid strategy, or a browser-based archive.

Preparing your data strategy now is crucial for a successful, future-proof conversion.

Platforms like DataManagement.AI help reduce the cost, time, and risk of core conversions and modernize your data infrastructure.

Your institution stands at a technological crossroads. A recent American Bankers Association survey reveals that one-third of financial institutions are dissatisfied with their core technology providers, a troubling sign of industry-wide tension.

Even more concerning: among banks with fewer than two years left on their contracts, nearly 60% are unhappy, and 40% are actively considering a switch.

This frustration comes at a time when you face mounting pressure to modernize operations, improve customer experience, and stay competitive in a digital-first world.

Yet despite these urgent needs, many banks remain locked in unsatisfactory relationships with their core providers.

Why? The staggering complexity and cost of core conversions, especially the formidable challenge of data migration.

Traditional data conversion projects are among the biggest barriers to core modernization. They demand heavy investment, long timelines, and often cause major operational disruption.

But the costs don’t stop there. Maintaining multiple legacy systems, licensing fees, upgrades, and support can drain thousands of dollars from your budget each year.

The data migration challenge is especially daunting when you consider the sheer volume of information you manage: decades of customer relationships, check images, loan documents, signature cards, and compliance records, often scattered across disconnected systems.

Converting this vast digital history while ensuring operational continuity and regulatory compliance can feel overwhelming.

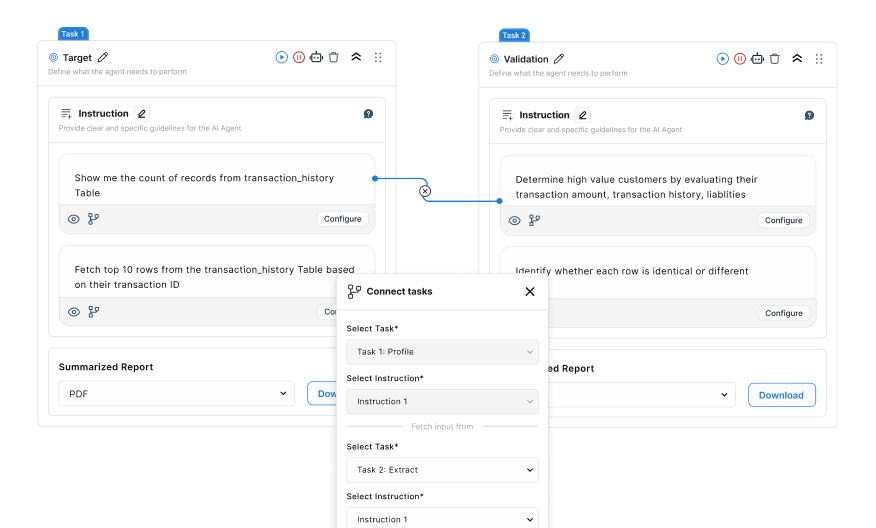

This is where a modern data foundation becomes essential. DataManagement.AI helps you cut through this complexity by offering intelligent data mapping, automated validation, and seamless integration, drastically reducing the time, cost, and risk involved in core migration.

Its AI-driven automation validates and standardizes data at scale, while built-in compliance ensures you don’t just move data, you move it with confidence.

A Strategic Approach to Data Migration

It’s important to remember that data migration isn’t just a technical task; it’s a strategic opportunity to optimize how you manage information and position yourself for future growth. Not all data is created equal.

Recent check images and loan documents need immediate integration with customer-facing systems, while older records may only require occasional access for compliance or research.

This distinction opens the door to smarter, more cost-effective approaches. Most archived data sees little use after 18 months, meaning you can prioritize what truly matters now while keeping historical data accessible without a full and costly conversion.

Three Paths for Legacy Data Management

When facing a core conversion or merger, you essentially have three options:

The Comprehensive Approach: Convert all legacy data into the new system. This offers a unified environment, but it comes with the highest cost and the longest timeline.

The Hybrid Strategy: Convert only critical, frequently accessed data into the new system, while maintaining older records in a separate, but searchable archive. This balances cost with functionality.

The Browser-Based Archive: The most economical solution. All historical data is loaded into a secure, searchable archive without costly conversion or re-indexing. It offers full access with minimal investment.

A tool like DataManagement.AI supports each of these paths, especially the hybrid and browser-based models, by enabling seamless data access across systems without requiring full migration.

It helps you future-proof your data infrastructure with API-ready architecture, remote conversion capabilities, and built-in compliance safeguards.

Building a Data-Ready Future

As M&A activity increases and more contracts near expiration, the banking industry may soon see a wave of core conversions. Preparing now is crucial, whether you’re modernizing in place or planning a switch.

Successful conversions require more than IT involvement; they need cross-functional teams from operations, compliance, and customer service.

Establishing a clear data strategy today will help you control costs, reduce risk, and maintain service quality throughout the transition.

With DataManagement.AI, you can build a scalable, intelligent data environment that supports not just your migration but your long-term innovation goals.

From automated quality checks to reconciliation protocols and audit trails, the right platform turns data migration from a burden into a strategic advantage.

The question isn’t whether change is coming; it’s whether your institution will be ready. Those who develop a clear data migration framework now will be best positioned to act when the time comes.

Begin your planning today with a platform designed for the future of banking. Explore how DataManagement.AI can help you navigate core conversion with confidence.

If you have an enterprise, we have different plans, as it is a one-tool solution for all solutions with expandable capabilities.

With a solid plan and the right enablers, you’re not just migrating workloads, you’re future-proofing your organization and unlocking the full potential of the cloud.

Thank you for reading

DataMigration.AI & Team